Canada Income Tax Gambling Winnings

- Paying Taxes On Gambling Winning

- Are Gambling Winnings Passive Income

- Federal Gambling Winnings Tax Rate

Paying Taxes On Gambling Winning

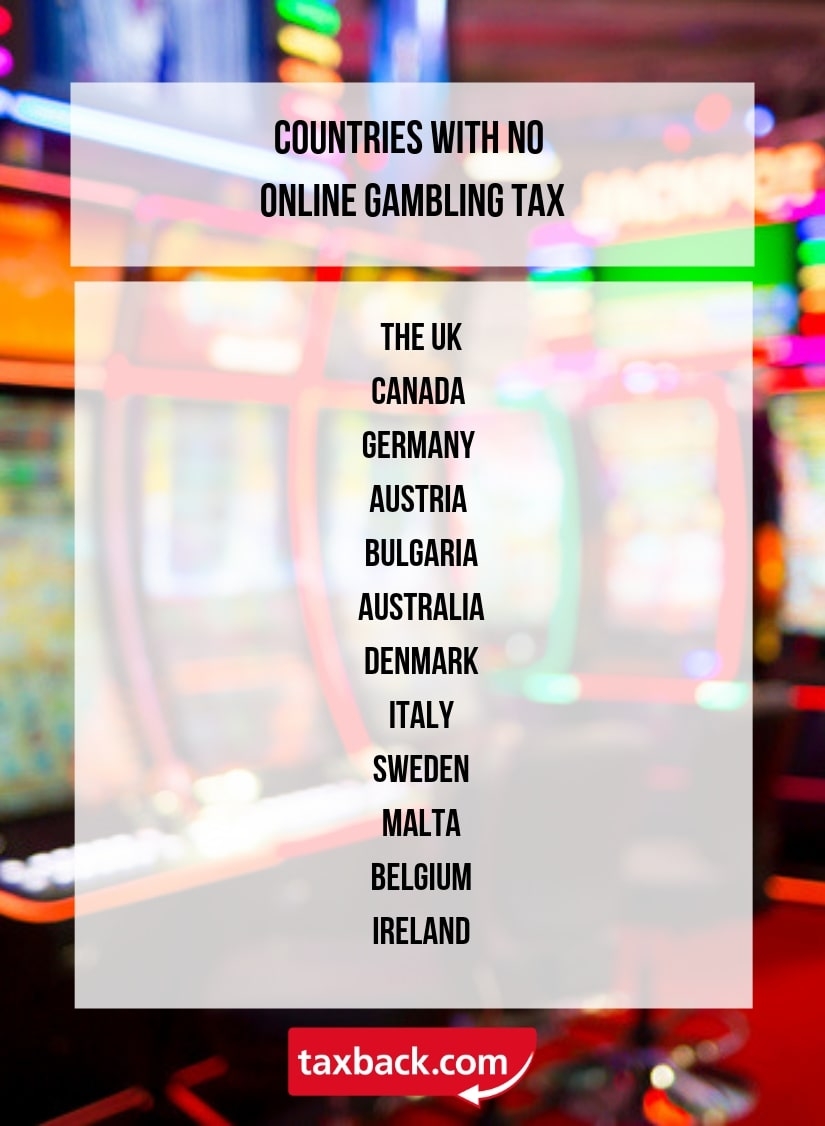

A professional gambler makes a business out of gambling. He can write off his gambling losses and any expenses that he incurs for gambling - like travel - to offset gambling income. Since gambling is a business, he would file a Schedule C to report his income and expenses and would also have to pay self-employment taxes on his profits. Gambling winnings are fully taxable and you must report the income on your tax return. Gambling income includes but isn't limited to winnings from lotteries, raffles, horse races, and casinos. It includes cash winnings and the fair market value of prizes, such as cars and trips. This Chapter discusses the tax treatment of various receipts, such as strike pay, gambling winnings, and forfeited deposits, which do not readily come within any of the more usual categories of income. Prizes from lottery schemes, pool system betting, and giveaway contests are also considered.

Are Gambling Winnings Passive Income

You do not have to report certain non-taxable amounts as income, including the following:

Federal Gambling Winnings Tax Rate

- any GST/HST credit and Canada child benefit payments, including those from related provincial or territorial programs

- child assisstance payments and the supplement for handicapped children paid by the province of Quebec

- compensation received from a province or territory if you were a victim of a criminal act or a motor vehicle accident

- most lottery winnings

- most gifts and inheritances

- amounts paid by Canada or an allied country (if the amount is not taxable in that country) for disability or death due to war service

- most amounts received from a life insurance policy following someone's death

- most types of strike pay you received from your union, even if you perform picketing duties as a requirement of membership

- elementary and secondary school scholarships and bursaries

- post-secondary school scholarships, fellowships, and bursaries received in 2018 are not taxable if you are considered a full-time qualifying student for 2017, 2018, or 2019

Note

Income earned on any of the above amounts (such as interest you earn when you invest lottery winnings) is taxable. - most amounts received from a tax-free savings account (TFSA).